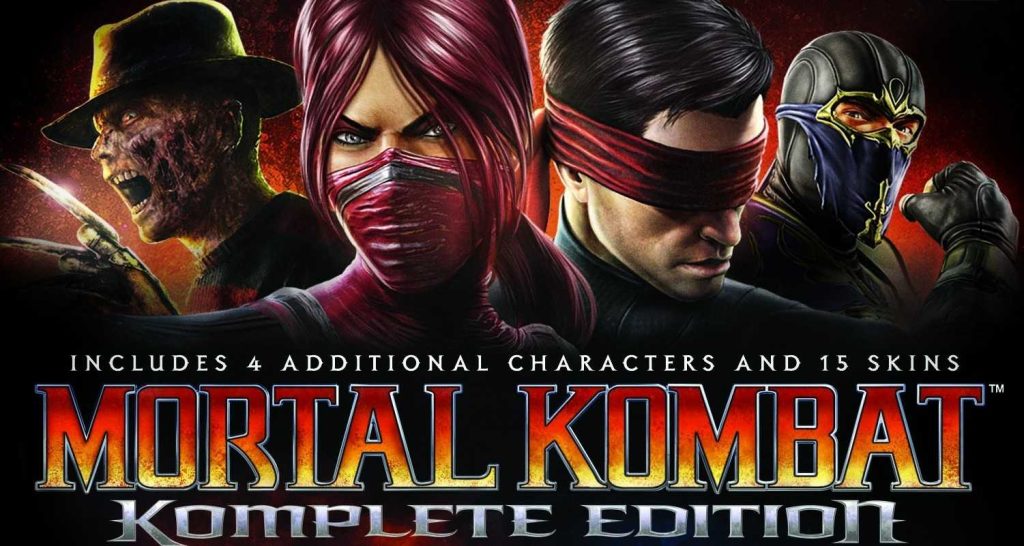

Mortal Kombat Komplete Edition PC Free Download

Mortal Kombat Komplete Edition is the best way to play the 2011 action game Mortal Kombat. This version is available for PlayStation 3, Xbox 360, and PC. It has all of the downloadable material. In the story, the evil sorcerer Shang Tsung has convinced the Mortal Kombat tournament host Shao Kahn to spare his Outworld realm from destruction. If Shang Tsung’s champions defeat Earthrealm’s fighters, Outworld will invade and conquer Earthrealm. Players can assume the roles of their favorite Mortal Kombat characters as they battle to protect Earthrealm.

Two people fight one-on-one with special moves and martial arts skills in the game. The fighting happens on a 2D plane, but the people and backgrounds are drawn in 3D. The fighting system is based on brutal, close-quarters battles, and when a fighter’s health is gone, they can use gruesome ending moves.

Moves utilize four attack buttons – front and back punches front and back kicks. Combinations and sequences of these buttons activate more damaging special moves unique to each fighter. This includes projectiles like Scorpion’s flaming spear or Sub-Zero’s ice blast. When an opponent is dazed, a combo linking various attacks can be activated.

Mortal Kombat Komplete Edition PC Free Download

The game features new x-ray moves that harm bones and organs in addition to the series’ signature Fatalities, which are very violent ways to end a fight. Tag battles between two teams, trials in a challenge tower, and a comprehensive tutorial explaining the fundamentals are the other game modes.

With over 30 playable classic Mortal Kombat heroes, a cinematic story mode, and enhanced combat, Mortal Kombat Complete Edition offers new and longtime fans the ultimate Mortal Kombat experience on PC. Brutal, visual, and competitive gameplay makes it the first entry in the fighting game series.

Main Playable Characters in Mortal Kombat Komplete Edition PC

- Scorpion: The iconic fiery ninja who seeks revenge against rival clan Sub-Zero. He is a deadly combo fighter with his kunai spear and hellfire powers.

- Sub-Zero: Member of the Lin Kuei clan who can freeze opponents with ice attacks. Rival of Scorpion. He seeks to turn his clan’s ways from dishonor to honor.

- Liu Kang: The Shaolin monk champion of Earthrealm. He uses acrobatic kicks and dragon-themed moves to defeat foes. Seeks to stop Outworld’s invasion.

- Raiden: The God of Thunder and protector of Earthrealm. He can teleport and wields lightning abilities. Mentors Liu Kang and others in defending Earth.

- Johnny Cage: Hollywood action movie star with shadow moves and cocky fighting style. Enters the tournament for fame but aids in Earth’s defense.

- Sonya Blade: Special Forces agent pursuing a Black Dragon criminal into the tournament. She uses fiery energy blasts and kickboxing in her moveset.

- Kano: Leader of the Black Dragon crime syndicate. His cybernetic eye fires laser beams, and he uses dirty fighting tactics.

- Shang Tsung: The evil sorcerer host of Mortal Kombat. He can morph into other fighters and steal souls. Serves the emperor Shao Kahn.

- Goro: Four-armed, half-human, half-dragon champion of Outworld. Towering brute strength with nasty grab moves. Sub-boss before Shao Kahn.

The key features of Mortal Kombat Komplete Edition were:

- The base Mortal Kombat (2011) game

- All previously released downloadable characters – Skarlet, Kenshi, Rain, Freddy Krueger

- 15 Klassic Mortal Kombat Skins

- All previously released downloadable content – alternate costumes, fatalities, arenas

- The Warrior’s Challenge mode with 300 challenge tower missions

No new story campaigns, missions, or gameplay modes were added in the Komplete Edition. It aimed to provide a comprehensive bundle for new players or existing owners who may have missed some DLC releases.

The Mortal Kombat team’s focus after Komplete Edition shifted to developing the next major sequel, Mortal Kombat X, which would launch with a new graphics engine, gameplay additions like variations, and new characters.

So, in summary, Mortal Kombat Komplete Edition on PC did not receive significant post-launch updates or new mission content. It combined all 2011 Mortal Kombat content into one definitive edition at launch.

Frequently asked questions for Mortal Kombat Komplete Edition on PC:

- What content is included in Mortal Kombat Komplete Edition?

Mortal Kombat Komplete includes the base 2011 Mortal Kombat game plus all previously released DLC characters, costumes, fatalities, and arenas. It also includes the Warrior’s Challenge with 300 mission towers.

- What gameplay modes are available?

The main modes are story mode, classic ladder arcade mode, online multiplayer versus player 2, tag team, challenge tower, and practice training.

- How is the PC version compared to the console?

The PC version includes improved visuals in 4K resolution. It supports keyboard and mouse controls as well as controllers. Early technical issues on the PC were patched. Overall, it’s a good-quality port.

- Does Mortal Kombat Komplete Edition have new or updated content?

No, the edition only compiles previously released Mortal Kombat 2011 content. There is no new story mode, characters, or gameplay features.

- How is the online multiplayer community?

Due to the game’s age, there are likely only a small number of dedicated players online. You may experience lag in finding matches. Peak times will have more players active.

- Is all DLC included, or do I need to buy anything extra?

Everything is included – all playable characters, costumes, fatalities, and stages released as DLC. There are no additional purchases needed to unlock content.

PROS

- Includes all DLC and content from the 2011 Mortal Kombat release

- A large roster of classic Mortal Kombat fighters to play as

- Cinematic story mode provides an interesting narrative background

- Brutal, visceral, and satisfying combat system

- X-ray moves and fatalities provide shock value

- Excellent visuals and animation with a dark, gritty style

- Runs in upscaled 4K resolution on PC hardware

- Good port from the console with customizable controls

- Additional challenge tower provides hours of gameplay

CONS

- The gameplay and graphics are unchanged from the 2011 release

- It can feel dated compared to more recent fighting games

- Some repetitive battles during the story mode

- The online multiplayer scene is likely very small due to the game’s age

- Unlock requirements for some content can feel like a grind

- No substantive new content has been added for Komplete Edition

- Lacks innovations of later Mortal Kombat games

- PC port had some early technical issues that required patching.

Minimum system requirements to run Mortal Kombat Komplete Edition on PC:

- OS: 64-bit Windows 7, Windows 8

- CPU: Intel Core i5-750 @ 2.67 GHz / AMD Phenom II X4 965 @ 3.4 GHz

- RAM: 3 GB

- GPU: NVIDIA GeForce GTX 460 / ATI Radeon HD 5850

- DirectX: Version 11

- Network: Broadband Internet connection

- Storage: 24 GB available space

- Additional: Microsoft Xbox 360 Controller or equivalent

Key points:

- Requires a 64-bit Windows 7 or newer version

- An Intel i5 or AMD Phenom II quad-core processor is minimum

- At least 3GB of system RAM

- Needs a DirectX 11 compatible video card like a GTX 460 or Radeon HD 5850

- Multiplayer requires a broadband internet connection

- A gamepad controller is recommended for an ideal gameplay experience

- 24GB of HDD space is needed to install the game